Which are the Arkansas Outlying Advancement Being qualified Areas?

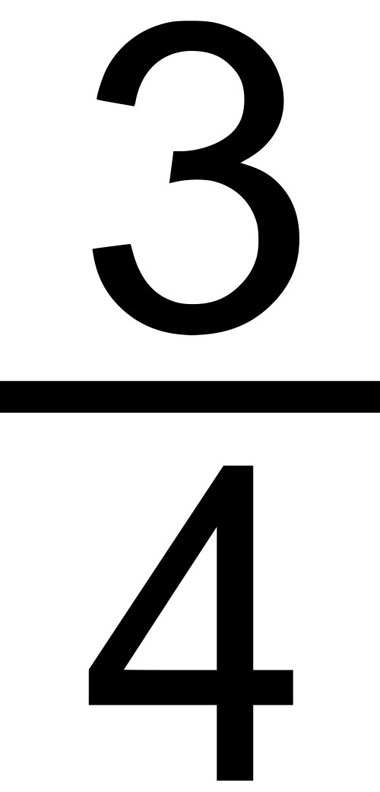

To possess homebuyers in the Arkansas that are researching brand new USDA home loan, they will find that the merchandise cannot commercially has actually home loan insurance policies, not, it can features the fee type of called a guarantee percentage. There are two main forms of this. An upfront and you may a yearly payment. Whenever you are you’ll find fees, these are the reasonable of the many mortgage typespared to your FHA loan who has got an excellent .85% monthly MIP the latest USDA mortgage merely charges .35%. An illustration might be into good $125,000 mortgage the price towards debtor to have an enthusiastic FHA mortgage could be $106 a month and that same loan amount towards USDA home loan would-be $thirty six four weeks. As you’re able the deals have become extreme.

The fresh new USDA mortgage is actually for home buyers that will be based in what’s considered outlying elements. This is a tiny misleading given that most of the newest United Says qualifies. The larger inhabitants portion are the locations that do not be considered. That is depending entirely toward populace. When you look at the Arkansas, a lot of the official qualifies. The top low-qualifying areas was towns and cities for example Absolutely nothing Stone, Jonesboro, Conway, and you can Fort Smith. In these section consumers often pick for the nearby teams otherwise describing components which might be most around the town stores. The ultimate way to determine if an area qualifies is to utilize the USDA qualification chart towards the USDA site lower than single-family homes system. The newest map is very simple to use. It’s just several simple steps. Profiles only have to enter the full address and you can hit go into and map will not only suggest if the a particular possessions qualifies it’s going to indicate in the event loans Terramuggus the surrounding section qualify or perhaps not according to additional color towards map.

The length of time Can it Sample Score A good Arkansas Outlying Development Mortgage?

The full time it requires to accomplish a house financing transaction making use of the USDA mortgage are different off bank to help you lender. The majority of the the procedure into USDA mortgage was just like any financing systems. The quality answer receive with a lot of lenders try 31-45 months with regards to the personal lender’s most recent works stream. You to definitely variation off their financing types happens when the lender try almost including the mortgage they need to posting the mortgage document to your USDA discover a relationship. Their change minutes into the review changes centered on workload. Inside the busier moments to usually takes as much as several weeks and you may during the much slower moments it might just be an excellent times.

Which are the Benefits of A Arkansas USDA Financing?

There are plenty of great benefits towards the Arkansas USDA loan. One that shines most frequently so you’re able to homebuyers is the 100% no cash down ability. The fresh USDA mortgage ‘s the only loan equipment to own low-pros that offers this particular feature. It’s a true no deposit loan. Besides this, there are numerous most other wonders about any of it mortgage tool for example because the 6% merchant concessions. Meaning the seller out of property will pay doing 6% of your own sales rate to the customers settlement costs and pre-paid back points. Toward good $95,000 transformation speed, this will be $5,700 toward these types of will set you back. In most instances, this could be ample to fund every people out of pocket expenses. An excellent element that we said prior to is actually the actual reasonable USDA ensure feepared to many other mortgage models that have a monthly fee this really is undoubtedly a low percentage at .35%. This significantly increases homebuyer’s cost otherwise to buy electricity. Borrowing independency is another attractive feature. Homebuyers need not features prime borrowing from the bank to participate the fresh new unmarried-nearest and dearest homes program. The credit score are prepared ahead by the bank and are also usually about low to help you middle 600 credit rating selections. Plus lower allowable fico scores individuals also can play with non-traditional tradelines to establish a credit score. Such things as phone commission records and you will power bills is most of the acceptable. Just like the mortgage equipment does require the the place to find be located from inside the a being qualified urban area this is usually perhaps not a hurdle just like the next to 98% of your You qualifies. For almost all carry out-be homebuyers interested in a property when you look at the a qualifying town is actually not too larger out of an issue.