Until amended, it seems that new Qualification would be a significant burden into new name team community and you can lenders

Within the household guidance supply, zero bank will get originate a great « tolerance financing » otherwise « large rates loan » versus basic assuring that the borrower has received guidance away from good housing counselor authorized by the Work environment regarding Houses and you may Area Development. The brand new housing counselor must provide the lending company that have observe that the debtor has had guidance toward « the fresh advisability of one’s financing deal together with appropriateness of your loan into the borrower depending everything available with borrower and you may financial on specialist at that time guidance is provided to your borrower. » Once again, the necessity from pre-loan counseling will not connect with deposit-providing financial institutions.

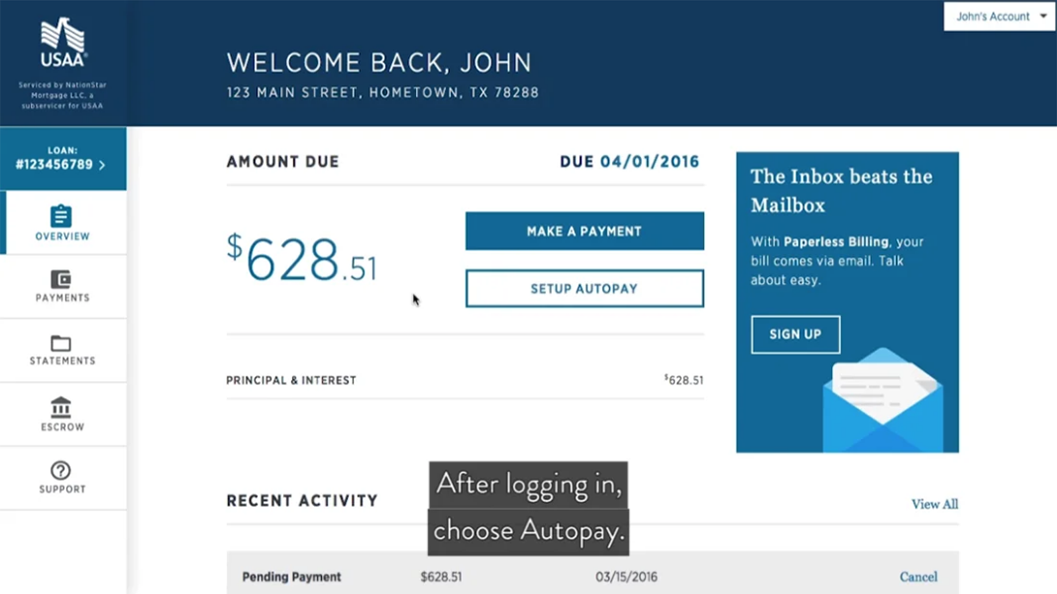

Really loan providers examine compulsory counseling because an extreme size that may slow the loan techniques immensely and certainly will suffice merely to annoy ab muscles consumers the drafters of the Ordinance allege it are making an effort to help. The newest Gran conveyed similar issues in the page so you’re able to Area Council, describing it is uncertain if necessary pre-mortgage counseling create impose one will set you back toward consumers, and also the Mayor asked whether the Area contains the info to render like compulsory pre-financing counseling.

The new Regulation restrictions a habit referred to as « equity removing » of the prohibiting a lender regarding originating an effective « threshold mortgage » otherwise « high rates loan » if your bank doesn’t believe this new borrower will have the ability to settle the borrowed funds based on his or her finances. A presumption of the borrower’s ability to repay the mortgage arises if: (i) the fresh new arranged mortgage money (also principal, focus, taxation, insurance policies and you will assessments) is actually below 50 % of the borrower’s documented and you will confirmed month-to-month gross income; and you will (ii) the latest borrower has actually enough continual earnings to spend remaining monthly expenditures and you may bills. Which provision is bound so you’re able to consumers with a reported earnings away from only 120 percent of your median loved ones income when you look at the Philadelphia.

According to research by the view of its drafters that home improvement fund is a routine discussion board having « predatory » financing methods, this new Regulation kits the fresh measures and you will restrictions getting home improvement money.

2nd, do-it-yourself builders are now actually required to provide a specified notice advising the consumer to be cautious in the providing home financing to a loan provider hence pre-mortgage domestic guidance may be needed

Basic, the brand new Ordinance forbids lenders from paying the proceeds out-of a beneficial « higher pricing » or « threshold loan » to your home improvement contractor aside from by the an instrument payable exclusively into borrower, or because of a 3rd-group escrow membership. 3rd, whatever the type of device used to disburse the fresh new continues of the property update resource, the newest Regulation prohibits the disbursement of greater than 25 percent away from the full continues from a beneficial « endurance loan » or « large prices loan » during closing.

Remember that that it see needs is really wider: that loan need not be an excellent « predatory mortgage » to help you cause necessary pre-mortgage counseling

Even the really intrusive the new processes mainly based by the Ordinance is an alternate mortgage degree requirement that weight Philadelphia’s already overworked file tape system with increased papers. Every mortgages filed inside Philadelphia, and not just « higher pricing » funds, need to be followed closely by a good lender’s qualification regarding conformity (the brand new « Certification ») attesting partly you to: (i) the mortgage was or perhaps is maybe not a great « endurance mortgage » otherwise « highest costs mortgage » underneath the Ordinance; (ii) the new debtor has otherwise has not yet obtained property guidance, if relevant; and you can (iii) the borrowed funds do otherwise does not break one provisions of your own Ordinance. The lender must also attach to new Degree a duplicate out of the fresh new document evidencing the debtor gotten the mandatory pre-loan domestic guidance.

First, the lender or mortgage broker must were to the Certification numerical information regarding the loan like the Annual percentage rate, this new situations and you can fees, and other data must use the fresh « highest rates financing » and « threshold mortgage » significance. This new Agencies out-of Information « will improve pointers found in like training accessible to the latest personal in the really available form brand new company practicably offer. » Although this provision is meant to permit interested parties to gather aggregate lending analysis, what’s more, it introduces confidentiality issues given that data necessary for the fresh Qualification generally speaking cannot get a hold of its ways to the an openly recorded mortgage file. Saying exactly the same privacy inquiries, the latest Gran stated the Ordinance « is apparently alot more far-interacting with and you may problematic than just laws and regulations enacted various other jurisdictions and may undoubtedly decide to try the newest external restrictions away from just what regional governing bodies can do so you can assault this matter. »