Retirement Planning: Difference Between A DC And A DB Plan

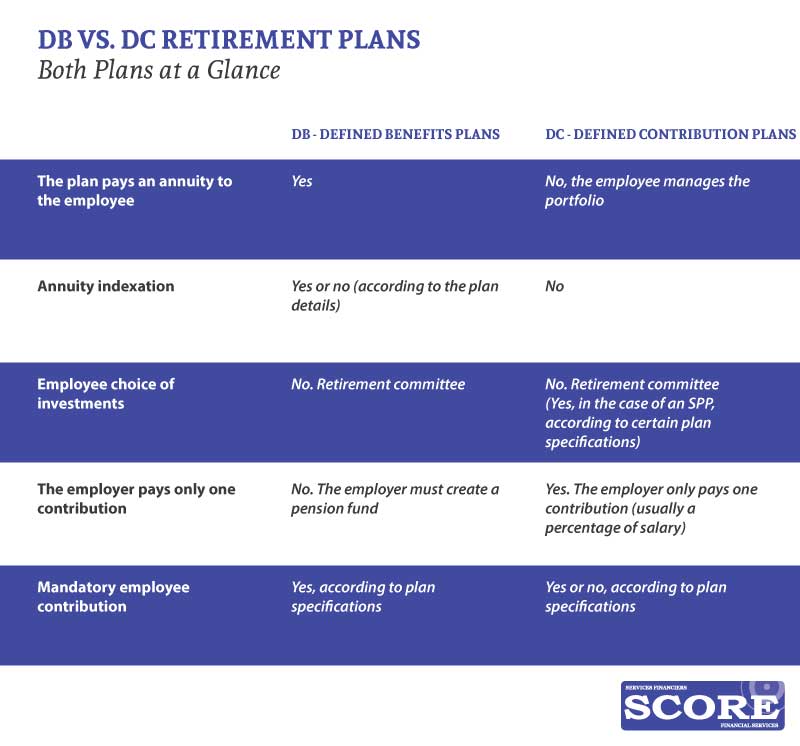

When companies are evaluating different retirement planning alternatives for their employees, they often discuss either DC or DB Plans:

- DC Plan or a Defined Contribution Retirement plans that work well for both medium and large businesses.

- DB Plan or a Defined Benefit Retirement plans that are more suitable for large businesses.

Registered Defined Contribution Pension Plan (DC Plan)

A structured retirement strategy allowing participants to save for retirement

This plan gives its participants the opportunity to save for their retirement, all while continuing to manage your business expenses. Additionally, you can require a minimum for employer contributions.

A Defined Contribution Retirement plan has the following characteristics:

- Contributions are taken before employee revenue is taxed

- Employer contributions and salaries and investment income are sheltered from taxes until retirement, under federal and provincial law

- Retirement income is funded by contributions that were made and their investment income

- Assets are generally locked-in, and are used to get a retirement income; it is important to take this into account before making a rapid decision when choosing between a RPP and an RRSP

Complete, integrated, and affordable DC plans:

- Help plan participants grow their savings, often through business fees and lower investments

- Offer options to plan participants, regardless oftheir knowledge or their level of interest investments – simple solutions up to personalized ones

Employer advantages

- Employee loyalty and mobilization

- Complement a valuable benefits package

- Minimal administration fees compared to Defined Benefits plans

Employee advantages

- Retirement income in addition to government benefits

- Tax benefit from employer contributions that aren’t counted as salary

- Tax-shielded investment income

- Transferable investment

- The employee manages their investment

Employer contributions

- Must represent at least 1% of the salary of participating employees

- Employer contributions are locked-in

Employee contributions

- Locked-in salary contributions

- Voluntary, supplementary contributions are not locked-in

More and more, companies are transitioning to DC plans. From the employer’s part of view, Defined Benefit plans are becoming more expensive to manage. Additionally, due to the lengthening life of employees, employers need to ensure that they have enough assets to support future liabilities, which is becoming more and more important with the aging population.

Registered Defined Benefit Pension Plan (DB Plan)

With a Defined Benefits plan, the payment amount at retirement is fixed ahead of time, according to a predetermined formula. This formula generally corresponds to a percentage of salary multiplied by the number of years worked.

A Defined Benefits Retirement plan offers you :

- A retirement income, calculated according to a predetermined formula, generally funded by employee earnings before retirement and years of service.

- A contributory plan (inludes salary contributions) or a non-contributory plan (includes only employer contributions).

Risks for employers

The risk of financing the plan is mainly taken on by the employer. If the plan assets are not enough to pay for all of the payments upon retirement and other plan benefits, the employer must deposit whatever is missing.

Risks for employees

The company may change the terms of their retirement plan, or freeze a DB plan and direct all new investments to a CD plan. In the case of bankruptcy of the business, the solvency of the plan may be affected because the business couldn’t continue to make contributions during those years. In the case of bankruptcy of a plan that was underfunded, employees may receive less than they expected.

There are still DB plans in Canada, but employees are offering more DC plans in their place. It is important that employees understand which type of plan they currently have, and how to factor it into their overall retirement planning.

The pension fund

The pension fund includes employer contributions, as well as any contributions the employee may have made. It represents the ‘’bank account’’ of the plan. Unlike CD plans, employer contributions are not distributed in the account of each plan member.

Currently, a lot of businesses are changing to DC plans for several reasons, some of which are costs and administration. DB plans are cost-prohibitive for small businesses and are usually found in large companies because they require regular, actuarial re-evaluations and investment discounts.

Currently, a lot of businesses are changing to DC plans for several reasons, some of which are costs and administration. DB plans are cost-prohibitive for small businesses and are usually found in large companies because they require regular, actuarial re-evaluations and investment discounts.

However, even large companies may re-evaluate a DB plan, with its retirement payments to a large group that’s living longer and find that the plan is becoming too costly, and decide to move to a DC plan.

DC plans relieve a bit of the burden caused by investment risk from employers, and transfer it to employees.

What happens at retirement?

If the plan participant exercised their right to transfer:

- They can use a Life Income Fund (LIF) to take out retirement income or purchase perpetuity from an insurance company. In this case, the perpetuity purchased from the insurance can be paid immediately or later, at the employee’s choice.

- The employee can first use other sources of income, leaving their savings in a Locked-In Retirement Account (LIRA) so it continues to grow.

If the participant has not exercised their right to transfer:

- Receive an annuity paid by the plan.

Retirement planning with SCORE Financial Services

For over 30 years, we have helped businesses give valuable and affordable benefits and group insurance plans to their employees. We can decipher the pros and cons of various retirement planning alternatives, both for your company and your employees. Contact us today for professional assistance in analyzing your options based on your unique situation.